Finally master debits and credits!

EasyAccounting explains the basics of double-entry bookkeeping simply and clearly in 44 compact chapters.

This great app teaches the basic principles and procedures of double-entry bookkeeping without referencing any specific laws or regulations, so people all over the world can use it no matter what accounting standards they are required to use.

The first 12 chapters are free; the other 32 are available for purchase as a complete package. After buying the full version, you can work through each chapter to unlock the next one, like leveling up in a computer game. New explanations build on information youve already covered, chapter by chapter.

The program gives students a thorough understanding of the basics they need to pass exams. Company managers can learn the material for the first time or refresh what they already know.

No previous knowledge is required – the program explains things from the very beginning.

EasyAccounting is based on the praxis-oriented teaching method developed by HPRühl™ for executive managers and business owners. Have fun while making rapid learning progress!

Content and functions:

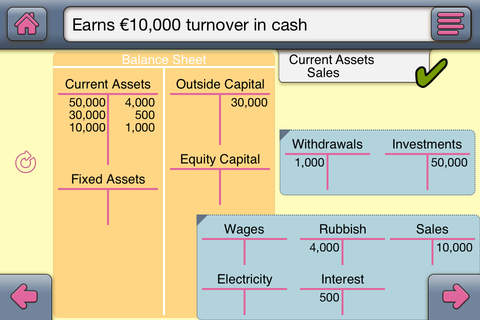

Users read basic explanations of different business transactions, then practice posting them using "debits" and "credits" by tapping the right T-accounts. This also helps them practice creating journal entries.

Each chapter is an independent unit which takes between 5 and 35 minutes to complete, so learners can build on their knowledge bit by bit.

Interesting practice exercises and easily understandable graphics round out the compact instructional units.

Multiple choice questions give users a fun way of checking their own learning progress.

Step by step, the app explains:

- the underlying business principles behind double-entry bookkeeping;

- what a balance sheet is;

- how business transactions change the balance sheet;

- what T-accounts and journal entries are;

- how to derive the correct journal entries for vouchers and receipts;

- what debits and credits are;

- what permanent, private, and revenue & expense accounts are;

- which kind of business transactions affect profit and loss;

- how to post to sub-accounts;

- how and why you post depreciations;

- what balancing an account is and why you do it;

- how the Profit & Loss account works;

- how to do a year-end closing;

- and how you can remember once and for all when to post debits and when to post credits.

The special topics chapters provide clear explanations of subjects like

- posting materials into stock or as expenses,

- materials requisition slips,

- outside capital,

- payables and receivables, and

- the cash book.

The last few chapters cover the basics of the three most important financial statements:

- income statements,

- owners equity statements, and

- cash flow statements.

Good luck with your learning!

Hans Peter Rühl

NOTE: This app explains the fundamentals of the double-entry bookkeeping system and gives users a basic understanding of the bookkeeping process. This knowledge helps you understand the basics of financial statements and prepare for exams. Due to the large number of additional legal specifications and regulations involved, those wanting to do company bookkeeping themselves will need formal training; otherwise, we advise you to hire a tax advisor or an accountant. For advanced bookkeeping you need to refer to a textbook covering advanced issues such as accruals and deferrals.